The EU Taxonomy Regulation (020/852) with its sister regulations such as (2021/2178) form a framework to facilitate sustainable investment within the European Union. It aims to direct capital flows towards sustainable investments to achieve sustainable and inclusive growth, contributing to the EU's objective of becoming climate-neutral by 2050.

The regulation introduces a unified classification system for sustainable activities, providing clear guidance on what qualifies as environmentally sustainable investments. This is crucial for investors, financial market participants, and economic operators, ensuring transparency, reducing market fragmentation, and avoiding "greenwashing."

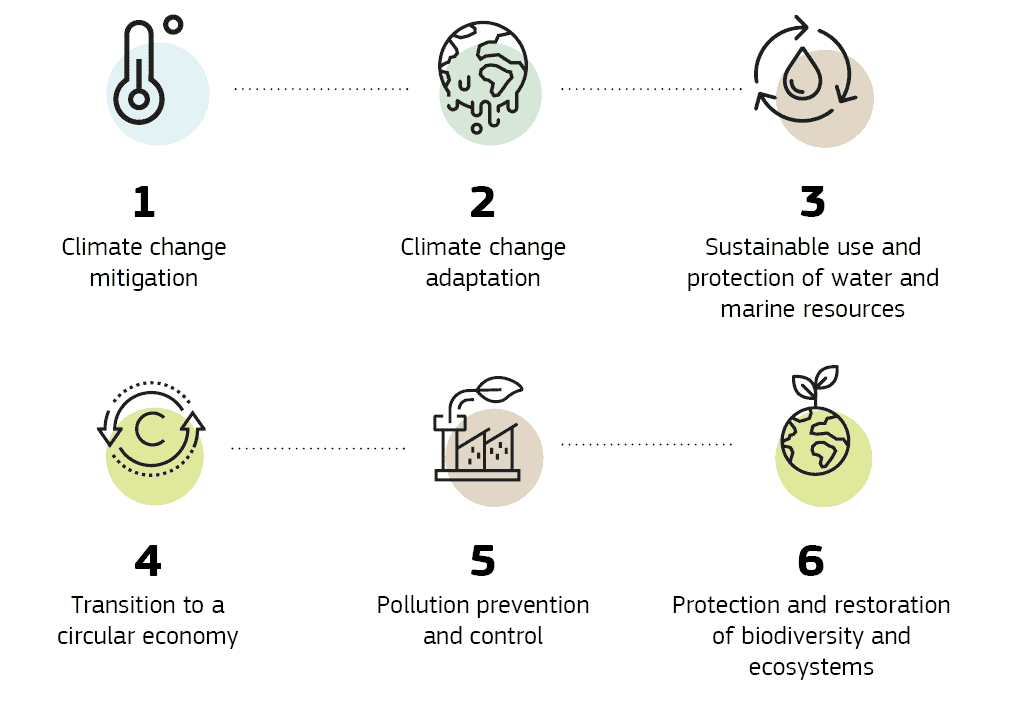

It sets out the following six environmental objectives each of which has to be measured by certain KPIs:

- Climate Change Mitigation: KPIs measure the extent to which companies' activities, investments, or financial products contribute to reducing greenhouse gas emissions. This is especially relevant for credit institutions and asset managers, who might invest in renewable energy projects or companies with low carbon footprints.

- Climate Change Adaptation: KPIs assess how companies' activities or investments enhance resilience to the adverse impacts of climate change, for example, through investing in infrastructure that is resilient to extreme weather events.

- Sustainable Use and Protection of Water and Marine Resources: KPIs for non-financial undertakings might include the proportion of their investments in technologies and processes that conserve water resources or protect marine biodiversity.

- Transition to a Circular Economy: KPIs could measure the investment in or revenue from activities that promote recycling, reusing, and reducing waste, indicating a move away from a linear economic model to a circular one.

- Pollution Prevention and Control: KPIs might reflect the extent to which undertakings invest in or engage in activities that minimize or eliminate the production of pollutants and toxic waste, contributing to cleaner air, water, and soil.

- Protection and Restoration of Biodiversity and Ecosystems: KPIs could assess investments in conservation projects or in companies that prioritize sustainable land use practices and biodiversity conservation.

These six environmental objectives are foundational to the Key Performance Indicators (KPIs) for various types of companies.

The following table summarizes the KPIs for each type ocompany as outlined in the 2021/2178 document, highlighting the focus on measuring the proportion of activities and investments aligned with environmentally sustainable economic activities under the EU Taxonomy.

Non-Financial Companies

Turnover KPI: Proportion of net turnover derived from Taxonomy-aligned activities

CapEx KPI: Proportion of capital expenditure on assets or processes associated with Taxonomy-aligned activities.

OpEx KPI: Proportion of operating expenses associated with Taxonomy-aligned activities.

Asset Managers

Numerator: Weighted average value of investments in Taxonomy-aligned activities of investee companies.

Denominator: Value of all Asset under Management (AuM) excluding specific exposures.

Asset managers disclose KPIs based on turnover and CapEx KPIs of investee companies.

Credit Institutions

Green Asset Ratio (GAR): Proportion of assets financing and invested in Taxonomy-aligned economic activities as a proportion of total covered assets.

The GAR includes on-balance sheet exposures such as loans, advances, debt securities, equity holdings, repossessed collaterals, and off-balance sheet exposures like financial guarantees and assets under management for guarantee purposes. It excludes specific assets like financial assets held for trading and on-demand interbank loans.

Credit institutions disclose GAR including a breakdown by environmental objective and type of counterparty.

Investment Firms

Investment firms are included under the broader category of financial undertakings, where relevant KPIs would be similar to those for asset managers and credit institutions, focusing on investments in Taxonomy-aligned activities. Specific KPIs for investment firms are not detailed separately but would align with the overarching principles of assessing the proportion of activities or investments aligned with the EU Taxonomy, considering both turnover-based and CapEx-based metrics.

Insurance and Reinsurance Companies

Insurance and reinsurance undertakings are expected to disclose investments and gross premiums written or total insurance revenue associated with Taxonomy-aligned activities, combined with the underwriting KPI for non-life insurance activities. The calculation and disclosure practices would align with the broader requirements for financial undertakings, focusing on the proportion of their business related to environmentally sustainable activities.

For each type of company, whether non-financial, asset managers, credit institutions, investment firms, or insurance and reinsurance company, the KPIs are designed to quantify and highlight the alignment of their activities or investments with these environmental objectives.

The regulation requires that these companies disclose the proportion of their activities or investments that are aligned with environmentally sustainable economic activities. This is based on technical screening criteria that define what constitutes a contribution to each of the six environmental objectives

This aligns with the Corporate Sustainability Reporting Directive (CSRD) and European Sustainability Reporting Standards (ESRS) by enhancing transparency, allowing investors and the public to assess the sustainability profile of entities, facilitating sustainable investment, and supporting the EU's climate and environmental goals.